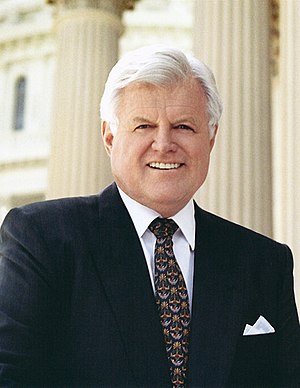

Image via Wikipedia

Image via Wikipedia

Another piece of Ted Kennedy’s dream of universal health care may be lost in the compromise meat grinder that has produced a deformed, complicated, top heavy and unpopular pro-insurance company bill – his proposal to begin building, for the first time, a civilized policy for the long term care of millions of elderly and disabled Americans.

First, the apparent loss of a strong public Medicare-like choice among the insurance options, included in Kennedy’s bill, will likely mean that private insurers won’t offer younger workers and aging boomers long term care insurance at an affordable price. Only a few employers, including the federal government, offer such policies.

But more specifically, there is doubt that Kennedy’s measure, called the CLASS Act (for Community Living Assistance Services and Support) will survive in the health reform legislation strong enough to be any good.

The CLASS Act, though far from adequate, would provide for workers to voluntarily contribute to individual accounts that eventually would pay part (perhaps $100 a day) of the cost of their long term care. Some suggest this should be mandatory.

It would be the first, small step towards a public program to eventually provide long term care for every American who needs it. Naturally, it is opposed by long term care insurers and their allies among Republicans, and conservative Democrats who worry more about the bottom line than people’s well-being.

So far, the proposal does not have a high priority among advocates of health care reform, including the White House, for they’re concentrating their efforts on the 47 million middle and working class people, mostly young, who are without basic health coverage.

Yet AARP said years ago that the lack of a long term care policy was the nation’s “greatest unmet health care need.” And little has changed. Just as the young don’t plan for the infirmities of age, it’s easy for policy makers to ignore the needs of elderly American couples facing the terrible time when one or the other needs long term nursing care – at home or in an institutional setting.

It didn’t have to be that way. President Obama, mistakenly, I think, abandoned his own earlier views and refused, from the beginning, to consider the long-standing congressional proposals by the two most senior House members – Michigan Democrats John Dingell (1955) and John Conyers (1965) – to provide Medicare for All. It would have gradually eliminated the costs of health insurance, which, along with payroll taxes would have financed universal health care including long term care. See the text of the bill here

But Obama, who has since retreated on the public option, said the country was not ready for Medicare for All despite advice to the contrary from his own Chicago-area doctors. But I doubt he even read the Dingell or Conyers bills, nor did most interested Americans, for as I’ve written, most of the main stream press blacked out these single-payer proposals for months while the debate was taking shape.

The Washington Post ignored these bills. Even the Kaiser Family Foundation, the Commonwealth Fund and AARP declined to include the proposals in their discussions on the grounds that they did not have a chance to pass, thus guaranteeing that their self-fulfilling prophecy would be fulfilled.

But I have digressed, for I meant to emphasize that among the biggest gaps in Medicare coverage – which many older Americans don’t realize - is that it does not cover long term nursing care. After a three-day hospital stay, Medicare will cover – with high co-payments to be paid by the beneficiary or his/her supplemental insurance – up to 100 days in a skilled nursing facility for rehabilitation, say for a hip replacement or to recover from an accident. And that’s all.

If your partner, spouse or loved one needs long term care, meaning help with what are called the “activities of daily living,” or ADLs, such as bathing and dressing, Medicare will only help pay for medical needs. I repeat, for nursing care, at home or in an institutional settling, there is no rational, national public program for the long term care of the elderly.

In this, America is alone among most of the countries of Europe; we say we venerate the aged, but our policy doesn’t reflect that.

There is long term care insurance, but the cost for a 65-year-old is hardly affordable at about $3,000 a year – if he or he has no illnesses and can qualify. The long term care insurance industry exhorts workers to buy when they are young and the cost is relatively inexpensive.

But chances are a person will pay the premiums for 25 years and never use the policy; less than one in three need long term care and nursing home stays are relatively short. A long term insurance policy usually has limits, in dollar amounts or the length of stay. And as an investment it sucks for unless you spend considerably more, there is no surrender value. If you don’t use it, you lose the thousands you’ve spent.

In addition, many insurers raise the premiums when the beneficiary is old and can least afford it. Not surprisingly, some drop their policies. Several insurers have changed hands, or they have sought to save money by challenging claims, when the beneficiary is at a disadvantage seeking to appeal. Most of the very old in nursing homes tend to be widows. And despite inflation riders in some policies (which cost more), many do not keep up with the cost of a nursing home, now averaging between $79,000 and $125,000 a year depending on where you live.

The Bush administration and Republican congresses, which rejected any public long term care program, have sought to encourage the purchase of long term care insurance by allowing people to deduct portions of the premiums as part of their medical costs. They’ve even encouraged people to take out reverse mortgages on their homes or sell their life insurance policies to finance long term care policies.

But more important, the last Republican-led congresses have sought to make it more difficult for the middle and working class elderly to use the only public program that has become a vehicle for long term care – Medicaid. It may be demeaning for families and couples to turn to welfare to get long term nursing care for a loved one, but it has been the only alternative for millions of the elderly.

Medicaid, passed around the same time as Medicare, is a federal program, administered by the states, that provides comprehensive medical care, including medicines, for the poor – people whose incomes are beneath or just above the official poverty line. But over the years, with the help of elder lawyers, families have found that with planning, they can “spend down” the savings of a loved one, impoverishing him or her, to get long term nursing care. That’s called “Medicaid planning” and it has become an elder law specialty.

A few years ago, at the behest of the long term care insurance industry, the Republican congress made Medicaid planning a crime, but the “granny goes to jail” attempt was unenforceable and dropped.

Nevertheless, Congress has since made it tougher to take advantage of Medicaid requiring, for example, that a beneficiary wait five years and exhaust his/her savings before becoming eligible for Medicaid in a nursing home.

Thus you are poor, but have worked most of your life, Medicaid long term care is a blessing, but it means spending your last days on welfare. And even those funds are being cut by many states hard-hit by the recession. Nursing homes by law may not discriminate between the paying and Medicaid patients, but they do. And fewer doctors will take Medicaid patients because compensation rates are low.

Among couples or families with modest nest eggs, their problem is how to avoid impoverishing the spouses (most are women) who remain at home when a loved one must be sent to a nursing home.

Under the arcane law, the spouse may keep half the couple’s assets up to around $109,000 (not counting the home, a car and the spouse’s personal IRAs, if any). In addition, the spouse is limited to a monthly allowance of up to $2,739 a month – not a lot to pay for food and other bills, taxes and upkeep on the home while looking after a husband in nursing care.

Some states allow the spouse to refuse to pay any bills for his/her loved one in nursing care and keep all their next egg, if any. That means that a wife must sign an affidavit abandoning financial responsibility for the father of her children. But even then, hard-up states can and do sue to get the Medicaid money back from women whose savings are diminishing.

I’ve gone at length into this thicket to demonstrate that middle-class families, as well as working couples who have been the backbone of American society, are obliged to scheme and, yes, cheat and give up their savings and dignity to get loved ones on welfare to obtain long term nursing care. That is how America treats millions of its older citizens.

A few year ago a woman, a former gym teacher in the New York public schools, told me that she had just put her husband in a nursing home because he was suffering from rapidly advancing Parkinson’s. A lawyer helped her impoverish him to get him on Medicaid. After years of hard work in the garment industry, he was on welfare and she hoped, with her teacher’s pension and their savings, she would have enough to live on for the rest of her days.

“Who knew we would live this long?” she lamented. Little has changed in the years since. And now, with all the talk of health reform, there will be no long term care and few seem to care.

Write saulfriedman@comcast.net

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=7f45d8c2-8e9a-4e38-ad4d-f2a726903fd5)

No comments:

Post a Comment