By Alexander Bolton

Sen. Kent Conrad (D-N.D.) on Tuesday presented a budget proposal to Senate Democrats that calls for an even balance — 50 percent to 50 percent — of spending cuts and tax increases to reduce the deficit.

More

This blog tracks aging and disability news. Legislative information is provided via GovTrack.us.

In the right sidebar and at the page bottom, bills in the categories of Aging, Disability, Medicare, Medicaid, and Social Security are tracked.

Clicking on the bill title will connect to GovTrack updated bill status.

Showing posts with label taxes. Show all posts

Showing posts with label taxes. Show all posts

Wednesday, May 11, 2011

Governor Rips Nursing-home Lobby, Says Tax Cut Possible in '12

By Joe Vardon - THE COLUMBUS DISPATCH

In a suburban Cincinnati facility where tooling for engines used by the military is made, Gov. John Kasich unleashed a volley of verbal missiles at Ohio's nursing-home lobby yesterday.

Kasich, whose speech was scheduled as an event to stump for his two-year, $55.6 billion budget proposal, also said that if the state holds the line on spending this year, "we will have a tax cut next year."

The governor declined to disclose the type or amount of tax cut after his speech. He has in the past floated the idea of eliminating Ohio's income tax.

But Kasich was largely focused on the nursing-home lobby, which got his attention with an ad paid for by the Ohio Health Care Association that began airing on Friday.

More

In a suburban Cincinnati facility where tooling for engines used by the military is made, Gov. John Kasich unleashed a volley of verbal missiles at Ohio's nursing-home lobby yesterday.

Kasich, whose speech was scheduled as an event to stump for his two-year, $55.6 billion budget proposal, also said that if the state holds the line on spending this year, "we will have a tax cut next year."

The governor declined to disclose the type or amount of tax cut after his speech. He has in the past floated the idea of eliminating Ohio's income tax.

But Kasich was largely focused on the nursing-home lobby, which got his attention with an ad paid for by the Ohio Health Care Association that began airing on Friday.

More

Friday, March 25, 2011

A Few Tax Tips for the Elderly - NYTimes.com

By PATRICK EGAN

With the tax-filing deadline bearing down, many of us are wrestling with financial issues particular to elder care. Opportunities to lower tax bills abound, thank goodness, but the details are often complicated or confusing — and most seniors can’t afford to leave money on the table. Here are a few details to keep in mind this year.

More

Tuesday, February 1, 2011

Monday, January 31, 2011

Press Releases | News from EPI: CBO Budget Report Shows Little Change to Social Security Outlook

By EPI economist Monique Morrissey

Yesterday’s Congressional Budget Office budget report showed that the weak economy continues to be a drag on Social Security’s short-term finances as payroll tax receipts lag pre-recession projections. Outlays are also higher than anticipated before the downturn, as Social Security has helped cushion the blow for older workers who have lost their jobs. This will have little impact on Social Security’s long-term finances, however, in part because workers who take early retirement receive reduced benefits.

Social Security is still projected to run an $868 billion surplus over the next decade, building up a trust fund sufficient to last through the peak baby boomer retirement years.

Nevertheless, gloomy news reports—in particular an Associated Press story by Stephen Ohlemacher—show that when it comes to Social Security, no news is bad news. The AP story claims that “Social Security will run at a deficit this year and keep on running in the red until its trust funds are drained by about 2037.” The story misrepresents the trust fund’s solvency by excluding interest earnings, a major source of revenue for Social Security. The article also fails to mention that even if nothing is done to shore up the system’s finances, current tax receipts will be sufficient to cover most benefits in 2037, which will still be higher in inflation-adjusted terms than benefits are today. Social Security is not in crisis.

A paper released yesterday by EPI looks at Social Security’s long-term finances, concluding that the biggest cause of Social Security’s projected long-term shortfall is not rising life expectancy or the baby boomer retirement, but rather stagnant wages and growing inequality.

Yesterday’s Congressional Budget Office budget report showed that the weak economy continues to be a drag on Social Security’s short-term finances as payroll tax receipts lag pre-recession projections. Outlays are also higher than anticipated before the downturn, as Social Security has helped cushion the blow for older workers who have lost their jobs. This will have little impact on Social Security’s long-term finances, however, in part because workers who take early retirement receive reduced benefits.

Social Security is still projected to run an $868 billion surplus over the next decade, building up a trust fund sufficient to last through the peak baby boomer retirement years.

Nevertheless, gloomy news reports—in particular an Associated Press story by Stephen Ohlemacher—show that when it comes to Social Security, no news is bad news. The AP story claims that “Social Security will run at a deficit this year and keep on running in the red until its trust funds are drained by about 2037.” The story misrepresents the trust fund’s solvency by excluding interest earnings, a major source of revenue for Social Security. The article also fails to mention that even if nothing is done to shore up the system’s finances, current tax receipts will be sufficient to cover most benefits in 2037, which will still be higher in inflation-adjusted terms than benefits are today. Social Security is not in crisis.

A paper released yesterday by EPI looks at Social Security’s long-term finances, concluding that the biggest cause of Social Security’s projected long-term shortfall is not rising life expectancy or the baby boomer retirement, but rather stagnant wages and growing inequality.

Saturday, January 29, 2011

TIME GOES BY | The State of the Union, Jobs and Social Security

by Ronni Bennett

President Barack Obama covered a lot of territory in his State of the Union address to Congress on Tuesday (transcript here). What was conspicuously missing, however, is the number one concern of the majority of Americans – jobs. The only reference he made - that the government would continue to fund infrastructure repair projects - contained no specifics.

Robert Reich, the former secretary of labor under President Clinton, had the most cogent response I read to this gaping hole in the speech:

On the morning after the speech, the non-partisan Congressional Budget Office announced that without legislative changes, Social Security will post a $45 billion shortfall for fiscal year 2011, meaning it will pay out that much more than it takes in. Shortfalls, said the CBO, are expected to continue until 2021.

Oh, my. Would that two percent payroll tax holiday enacted by Congress with the extension of the Bush tax cuts for the wealthy have anything to do with this shortfall? After all, it does amount to 15 percent of Social Security revenue - money that is lost forever.

And it's going to be a pitched battle with the Republicans later this year not to extend the payroll holiday when it expires because it is the first successful inroad made against the program since it was created in 1935.

I think we can take a bit of credit, along with many progressives throughout the land, thanks to our letters to the White House and petitions, that the president did not continue the attack on Social Security Tuesday by endorsing deeper cuts suggested by the cat food commission and other Republicans.

Here is what he did say, buried in a section about the deficit:

And, there was no mention of the cost-of-living (COLA) formula which some Republicans want to change that would result in smaller increases for current and future Social Security beneficiaries.

It is probably a poor idea to parse as minutely as this what the president said about Social Security (or anything else). Life moves on, politicians renege on promises every day and most people are already forgetting the SOTU now, three days later.

What is so disappointing about the president ignoring the subject of jobs on Tuesday is that full employment increases all taxes reducing or eliminating the need to cut funding for schools, fire, police and other public services, and keeping Social Security strong.

The two biggest moves that will revive the middle class and get our nation back on a sound economic footing are jobs and a tax structure in which the wealthy pay as big a share of their income as everyone else. For Social Security, removing the salary cap is a start.

Our fight to preserve and strengthen Social Security is not done just because the president sounded support in one speech. He already signed legislation that cut Social Security revenue by 15 percent.

TIME GOES BY | The State of the Union, Jobs and Social Security

President Barack Obama covered a lot of territory in his State of the Union address to Congress on Tuesday (transcript here). What was conspicuously missing, however, is the number one concern of the majority of Americans – jobs. The only reference he made - that the government would continue to fund infrastructure repair projects - contained no specifics.

Robert Reich, the former secretary of labor under President Clinton, had the most cogent response I read to this gaping hole in the speech:

”[T]he President’s failure to address the decoupling of American corporate profits from American jobs, and explain specifically what he’ll do to get jobs back...risks making his grand plans for reviving the nation’s 'competitiveness' seem somewhat beside the point...A large part of that "making money wherever" is making money from money instead of goods and services - Wall Street stock and bond fees, dividends, interest, etc. Taxes are much lower on those transactions than on income and there is no FICA tax on corporate revenue. Which brings me to this:

“What the President should have done is talk frankly about the central structural flaw in the U.S. economy – the dwindling share of its gains going to the vast middle class, and the almost unprecedented concentration of income and wealth at top – in sharp contrast to the Eisenhower and Kennedy years.

“Importantly, it would give him a convincing counter-narrative to the Republican anti-government one. Government exists to protect and advance the interests of average working families. Without it, Americans have to rely mainly on big and increasingly global corporations, whose only interest is making money wherever it can be made.”

On the morning after the speech, the non-partisan Congressional Budget Office announced that without legislative changes, Social Security will post a $45 billion shortfall for fiscal year 2011, meaning it will pay out that much more than it takes in. Shortfalls, said the CBO, are expected to continue until 2021.

Oh, my. Would that two percent payroll tax holiday enacted by Congress with the extension of the Bush tax cuts for the wealthy have anything to do with this shortfall? After all, it does amount to 15 percent of Social Security revenue - money that is lost forever.

And it's going to be a pitched battle with the Republicans later this year not to extend the payroll holiday when it expires because it is the first successful inroad made against the program since it was created in 1935.

I think we can take a bit of credit, along with many progressives throughout the land, thanks to our letters to the White House and petitions, that the president did not continue the attack on Social Security Tuesday by endorsing deeper cuts suggested by the cat food commission and other Republicans.

Here is what he did say, buried in a section about the deficit:

“To put us on solid ground, we should also find a bipartisan solution to strengthen Social Security for future generations. We must do it without putting at risk current retirees, the most vulnerable, or people with disabilities; without slashing benefits for future generations; and without subjecting Americans’ guaranteed retirement income to the whims of the stock market.Notably missing is a reference to not raising the age at which people are eligible for full Social Security benefits. I'm a little concerned, too, with that adjective, “slashing,” in the first paragraph which could imply cutting at a rate that is not viewed as extreme.

“And if we truly care about our deficit, we simply can’t afford a permanent extension of the tax cuts for the wealthiest two percent of Americans. Before we take money away from our schools or scholarships away from our students, we should ask millionaires to give up their tax break. It’s not a matter of punishing their success. It’s about promoting America’s success.”

And, there was no mention of the cost-of-living (COLA) formula which some Republicans want to change that would result in smaller increases for current and future Social Security beneficiaries.

It is probably a poor idea to parse as minutely as this what the president said about Social Security (or anything else). Life moves on, politicians renege on promises every day and most people are already forgetting the SOTU now, three days later.

What is so disappointing about the president ignoring the subject of jobs on Tuesday is that full employment increases all taxes reducing or eliminating the need to cut funding for schools, fire, police and other public services, and keeping Social Security strong.

The two biggest moves that will revive the middle class and get our nation back on a sound economic footing are jobs and a tax structure in which the wealthy pay as big a share of their income as everyone else. For Social Security, removing the salary cap is a start.

Our fight to preserve and strengthen Social Security is not done just because the president sounded support in one speech. He already signed legislation that cut Social Security revenue by 15 percent.

TIME GOES BY | The State of the Union, Jobs and Social Security

Thursday, January 20, 2011

Israel May Increase Healthcare Tax to Pay for Aging Population

Many countries have been concerned with how to best pay for aging baby boomers and seniors. Israel's deputy health minister Yaakov Litzman recently proposed increasing the country's healthcare tax by 0.5 percent to pay for geriatric insurance for all citizens, according to the Haaretz newspaper.

Approximately 64 percent of Israelis have an iteration of this package, but these are generally only offered by extended insurance plans.

Litzman announced the new reform at a recent conference at the National Institute for Health Policy, explaining that it would be the next big change in the healthcare system, the news source reports.

Full Article

Approximately 64 percent of Israelis have an iteration of this package, but these are generally only offered by extended insurance plans.

Litzman announced the new reform at a recent conference at the National Institute for Health Policy, explaining that it would be the next big change in the healthcare system, the news source reports.

Full Article

Friday, January 14, 2011

Health Care Facility Inspections to be Cut if Fees Not Raised - Las Vegas Sun

Image via Wikipedia

Image via WikipediaIf a panel of elected officials in Nevada rejects a proposal to increase health care facility licensing fees today as it did in October some state healthcare facilities inspectors will lose their jobs and the health care facility inspections will be greatly reduced, state officials said. The proposed fee increases are exponential in some cases, which has caused sticker shock for the facilities. Their lobbyist argues that the state, not the businesses, should bear the financial weight of protecting the public. "This amounts to what somebody calls a 'sick tax,'" said Charles Perry, president/CEO of the Nevada Health Care Association, the lobbying group for long-term care facilities.

Full Article

Saturday, January 8, 2011

H.R. 150: To amend the Internal Revenue Code of 1986 to repeal the inclusion in gross income of Social... (GovTrack.us)

To amend the Internal Revenue Code of 1986 to repeal the inclusion in gross income of Social Security benefits.

Current Status

Sponsor:

|

Rep. Ronald Paul [R-TX14](no cosponsors)

Cosponsors:

| ||||||||||||||||||

Text:

| The text of this legislation is not yet available on GovTrack. It may not have been made available by the Government Printing Office yet. | ||||||||||||||||||

Status:

|

This bill is in the first step in the legislative process. Introduced bills and resolutions first go to committees that deliberate, investigate, and revise them before they go to general debate. The majority of bills and resolutions never make it out of committee. [Last Updated: Jan 6, 2011 11:29AM]

| ||||||||||||||||||

| Jan 5, 2011: Referred to the House Committee on Ways and Means. |

Current Status

H.R. 136: To amend the Internal Revenue Code of 1986 to allow taxpayers to designate a portion of their... (GovTrack.us)

To amend the Internal Revenue Code of 1986 to allow taxpayers to designate a portion of their income tax payment to provide assistance to homeless veterans, and for other purposes.

Current Status

Sponsor:

| |||||||||||||||||||

Text:

| The text of this legislation is not yet available on GovTrack. It may not have been made available by the Government Printing Office yet. | ||||||||||||||||||

Status:

|

This bill is in the first step in the legislative process. Introduced bills and resolutions first go to committees that deliberate, investigate, and revise them before they go to general debate. The majority of bills and resolutions never make it out of committee. [Last Updated: Jan 7, 2011 6:17AM]

| ||||||||||||||||||

| Jan 5, 2011: Referred to House Veterans' Affairs |

Current Status

Monday, January 3, 2011

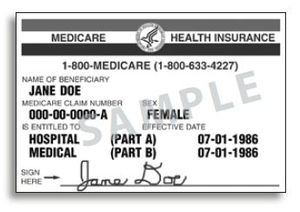

Analysis Illustrates Big Gap Between Medicare Taxes and Benefits

Image via WikipediaBy Ricardo Alonso-Zaldivar

Image via WikipediaBy Ricardo Alonso-Zaldivar You paid your Medicare taxes all those years and want your money's worth: full benefits after you retire.

Nearly three out of five people said in a recent Associated Press-GfK poll that people who paid into the system deserve their full benefits - no cuts.

But an updated financial analysis shows that the amount workers have paid does not come close to covering the full value of the medical care they can expect to receive as retirees.

Full Article

Sunday, January 2, 2011

IRS Releases New Schedule R for Fiscal/Employer Agents

Schedule R for Form 940 is specifically required for "section 3504 Agents acting on behalf of home care service recipients" (more commonly, Fiscal/Employer Agents serving employers in participant direction programs). The purpose of the Schedule R for Form 940 is to allocate the aggregate information reported on Form 940 to each home care service recipient client (participant direction employer). Fiscal/Employer Agents serving participant direction employers in 2010 must complete and submit a Schedule R with the 2010 Form 940, Employer's Annual Federal Unemployment (FUTA) Tax Return. This requirement applies to both Vendor and Government Fiscal/Employer Agents.

The IRS is expected to release a "Stakeholder Partners' Headliner" announcing the Schedule R for Form 940 very soon. For more information, follow the National Resource Center for Particpant-Directed Services (NRCPDS) on Facebook for updates.

The Center for Participant-Directed Services is aware of a free tool to support Fiscal/Employer Agents' completion of Schedule R for Form 940. 941RExpress, a product of Annkissam, will be updated by December 18 to support Schedule R for Form 940 (in addition to the current support of Schedule R for Form 941). Check 941RExpress.com on or after December 18, 2010 for more information about using the free tool.

Click here for the form.

The IRS is expected to release a "Stakeholder Partners' Headliner" announcing the Schedule R for Form 940 very soon. For more information, follow the National Resource Center for Particpant-Directed Services (NRCPDS) on Facebook for updates.

The Center for Participant-Directed Services is aware of a free tool to support Fiscal/Employer Agents' completion of Schedule R for Form 940. 941RExpress, a product of Annkissam, will be updated by December 18 to support Schedule R for Form 940 (in addition to the current support of Schedule R for Form 941). Check 941RExpress.com on or after December 18, 2010 for more information about using the free tool.

Click here for the form.

Thursday, December 30, 2010

OMG Social Security!? - The Boston Globe

Image via WikipediaBy Heather Boushey

Image via WikipediaBy Heather BousheyIF YOU watch the political debates in Washington, you’d think that the future of Social Security matters only to today’s retirees. But the Social Security’s future solvency is most germane to the 40-and-under crowd.

Continue Reading

Social Security 'tax holiday': the unkindest cut of all - NJ.com

Image via WikipediaBy Rush Holt, D-Hopewell, represents the 12th Congressional District of New Jersey and Eileen Appelbaum is senior economist at the Center for Economic and Policy Research.

Image via WikipediaBy Rush Holt, D-Hopewell, represents the 12th Congressional District of New Jersey and Eileen Appelbaum is senior economist at the Center for Economic and Policy Research.Nothing in the tax compromise worked out between the White House and congressional Republicans is fraught with as much danger to the economic security of working Americans as the partial payroll tax holiday.

Since its inception 75 years ago, Social Security has provided a dependable retirement income for millions of workers who contributed to the program during their working years. For many of these senior citizens, it has meant the difference between a dignified old age and the ignominy of poverty. And for 75 years, the enemies of Social Security have tried without success to undermine the program.

Democrats have strongly resisted every one of these efforts to undermine the Social Security system -- until now.

Continue Reading

Tuesday, December 21, 2010

Allan Sloan - New tax law reveals the mirage of the Social Security trust fund

Image via WikipediaBy Allan Sloan

Image via WikipediaBy Allan SloanI used to joke about the government "solving" Social Security's long-term problems by creating Treasury IOUs out of thin air and sticking them in the program's trust fund. My point, of course, was to show that no matter how many Treasury securities there are in the trust fund - currently about $2.6 trillion - the fund is merely an accounting fiction that has no economic value when it comes to protecting Social Security beneficiaries.

Now, with last week's passage of the much-ballyhooed tax deal between President Obama and Republican lawmakers, my sarcastic joke has become public policy. It all has to do with the provision cutting payroll taxes in 2011.

Full Article

Sunday, October 17, 2010

New Small Business Law Could Have Big Effect On Retirement Accounts

A new law aimed at helping stimulate small business job growth through tax deductions could have major consequences for anyone with a retirement savings account at work, a University of Illinois expert on taxation and elder law notes.

Law professor Richard L. Kaplan says an obscure provision in the recently enacted Small Business Jobs Act allows 401(k), 403(b) or 457 account holders to convert their retirement savings into a tax-advantaged Roth-version of the same account.

The good news, according to Kaplan, is that by converting to a Roth variant, income can grow completely tax-free because no tax is assessed when funds are withdrawn from a Roth account during retirement.

The bad news: Those who convert retirement savings account to Roth plans must report the amount converted as income, a move that could potentially bump them up into a higher tax bracket.

Source: Phil Ciciora University of Illinois at Urbana-Champaign

Full Article

Law professor Richard L. Kaplan says an obscure provision in the recently enacted Small Business Jobs Act allows 401(k), 403(b) or 457 account holders to convert their retirement savings into a tax-advantaged Roth-version of the same account.

The good news, according to Kaplan, is that by converting to a Roth variant, income can grow completely tax-free because no tax is assessed when funds are withdrawn from a Roth account during retirement.

The bad news: Those who convert retirement savings account to Roth plans must report the amount converted as income, a move that could potentially bump them up into a higher tax bracket.

Source: Phil Ciciora University of Illinois at Urbana-Champaign

Full Article

Friday, July 2, 2010

New Fiscal Year Brings More Grief for State Budgets, Putting Economic Recovery at Risk — Center on Budget and Policy Priorities

Image by dj @ oxherder arts via Flickr

Image by dj @ oxherder arts via FlickrDismal state revenue collections caused by the severe recession are setting the stage for a new round of state budget cuts as fiscal year 2011 begins in most states on July 1. The states’ cumulative budget shortfall will likely reach $140 billion in the coming year, the largest shortfall yet in a string of huge annual gaps that date back to the beginning of the recession. Closing it will have severe effects on services and jobs.

In many states, the new fiscal year will bring immediate cuts to programs and services that are facing unprecedented demand. As of July 1, 10,000 families in Arizona will lose eligibility for temporary cash assistance; Georgia will lay off as many as 284 workers who help low-income families enroll for food stamp, Medicaid and TANF benefits; and Kansas will cut off nearly 2,800 individuals with a disability from independent living services. Education, health care, and other priority areas will also face new cuts in the coming fiscal year — on top of extensive cuts that at least 45 states have enacted over the last two years.

States are raising taxes as well for 2011. Effective July 1, Kansas and New Mexico increase their sales taxes; Hawaii, New Mexico, New York, South Carolina, and Utah increase their tax on tobacco products; Washington begins taxing soda, and Oklahoma is temporarily suspending various business and energy tax credits. Other changes have already taken effect or will take effect later in fiscal year 2011. Since 2008, more than 30 states have raised taxes or tax-like fees.

Separate and apart from dismal revenue collections, the budget situation for states just got worse. Last week, the U.S. Senate failed to pass jobs legislation that would have extended an enhanced federal match for the Medicaid program that 30 states were counting on to balance their budgets. Without these funds, states will make even deeper spending cuts and more tax increases than previously planned.

These state actions, while necessary to meet state balanced-budget requirements, will nevertheless slow the economic recovery and raise the risk that the nation will fall back into recession as the loss of Americans’ spending power ripples through the economy. States’ actions to close their $140 billion gap without more federal aid could cost the economy up to 900,000 public- and private-sector jobs.

Continue Reading

Related articles by Zemanta

- Fiscal 2011 could be hardest yet for states (reuters.com)

- Editorial: Bad News Back Home (nytimes.com)

- Gov. Patrick signs $27.6B 2011 Mass. state budget (seattletimes.nwsource.com)

- Ariz. Lawmaker: Cuts a Must Without Stimulus Cash (abcnews.go.com)

Unlimited Estate Tax Exemption For Farm Estates Is Unnecessary and Likely Harmful — Center on Budget and Policy Priorities

Image via Wikipedia

Image via WikipediaProponents of repealing the estate tax have made farmers, along with small business, the face of their cause, driving some policymakers to push for special preferences for farms in estate tax law. One of the most radical of these proposed changes is an unlimited estate tax exemption for farmland, recently introduced by Rep. Mike Thompson (D-CA) in H.R. 5475. This approach is seriously misguided, for three basic reasons.

Continue Reading

Sunday, March 14, 2010

Ryan’s Response to Center’s Analysis of “Roadmap” Is Off Base — Center on Budget and Policy Priorities

Image via Wikipedia

Image via Wikipedia

We are quite disappointed that, in responding to our analysis of his budget plan, Rep. Paul Ryan accuses the Center on Budget and Policy Priorities of “partisan demagoguery” as well as “factual errors and misleading statements.” Quite the contrary, we applied the same rigorous analytical process to Rep. Ryan’s Roadmap for America’s Future that we do to every issue we study. We worked for more than a month on our analysis, and we believe that, if anything, we bent over backwards to make sure we were fair to the Congressman and his plan. Frankly, based on the attack on our analysis that Rep. Ryan issued yesterday, we took his plan far more seriously than he took our analysis of it.

Rep. Ryan accuses us of partisanship, but we relied on the best nonpartisan sources available. The Tax Policy Center, on whose revenue estimates we relied heavily, is a highly respected, nonpartisan institution whose codirector, Rosanne Altshuler, was senior economist for President George W. Bush’s Advisory Panel on Federal Tax Reform in 2005. Our other key sources of information included the nonpartisan Congressional Budget Office and the Chief Actuary of the Social Security Administration. Rep. Ryan says that we made errors and misleading statements, but it is he — not we — who has done so. He ignores what we wrote and accuses us of writing things that we did not. In fact, he even selectively deletes words from a sentence that he quotes from one of our earlier reports to change the clear meaning of what we wrote. He also inaccurately represents some important aspects of CBO’s analysis of his plan.

As outlined below, we examined every one of Rep. Ryan’s complaints about our work, and not a single one withstands scrutiny.

Continue Reading

Complete 4 page report

Subscribe to:

Posts (Atom)

![Reblog this post [with Zemanta]](http://img.zemanta.com/reblog_b.png?x-id=d29084ba-88b8-499c-81e8-082e93187189)